Since 2025, trading turnover in the A-share market has repeatedly reached new highs, even breaking through the RMB 2 trillion mark. Alongside this, the overall returns of quantitative strategies have improved significantly. From the performance of the market-neutral index, we can see that during active market periods (such as since September 2024), quant products have delivered noticeably better returns than in relatively sluggish periods (such as January–August 2024).

Sources: Simuwang, Choice.

Why is quant performance so closely tied to market activity?

One of the key factors behind this is liquidity.

01 Where does liquidity flow?

Liquidity can be simply understood as: when you want to buy or sell a large block of assets, can the trade be executed quickly at a price close to the current market level?

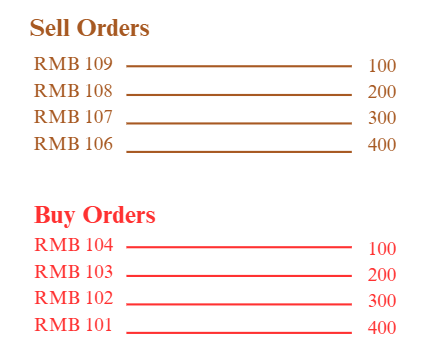

Take a stock’s order book as an example: suppose the current price is RMB 105. If a retail investor wants to buy one lot, and there happen to be two lots of sell orders at RMB 106, the trade will be matched quickly with almost no price movement—this single transaction barely impacts the market.

Low Liquidity Orderbook Example:

But for a large institution, things are more complex. Suppose it wants to buy 100 lots. If there aren’t enough sell orders to absorb that demand at once, the order will eat into higher price levels, pushing the final execution price well above RMB 105. The extra cost is the market impact cost.

High Liquidity Order Book Example 2:

For institutions, the ideal market looks like this: every price level is filled with buy and sell orders, spreads are narrow, and even large trades can be executed quickly without much price disruption.

Think of the market as a restaurant. A high-liquidity market is like a well-stocked kitchen: once you order, dishes come out quickly, and even if you order more, prices don’t spike because ingredients are plentiful.

02 Why do quant strategies prefer high liquidity?

Quant trading typically has two characteristics:

High trading frequency – compared to discretionary investors, quants buy and sell more frequently.

Diversified holdings – often holding hundreds or even thousands of positions at the same time.

This is like a group of diners who prefer ordering many small fast dishes. To keep service quick and turnover high, the kitchen must be well-stocked. High liquidity plays that role.

Benefits of high liquidity for quant strategies include:

Easy execution: Orders are quickly matched, making strategy implementation efficient.

Lower impact costs: Trades don’t significantly move prices due to lack of counterparties.

Larger strategy capacity: Even with bigger AUM, trades can be executed smoothly without self-induced market moves.

More mispricing opportunities: Higher volumes create more short-term price dislocations to exploit.

Liquidity directly affects transaction costs and execution efficiency. High-frequency strategies—based on price/volume signals and rapid portfolio turnover—rely on order book depth, width, and spreads to capture tiny deviations. When liquidity is scarce, market impact rises, and trading costs go up.

High-frequency profits come from accumulating small gains. Even slight slippage in one trade can wipe out that profit.

Source: Zheshang Securities.

03 What about when liquidity is weak?

High liquidity favors quants, but liquidity itself is cyclical. When the market is quiet, does that mean quant strategies can’t outperform? Not necessarily.

Quant returns come from trading and holding positions. When turnover is subdued, quants can still generate alpha from optimized holdings.

Compared with high-frequency price/volume strategies, mid- to low-frequency fundamental strategies have longer holding periods and lower trading frequency. They focus on earnings, valuations, and other medium- to long-term fundamentals, not second-by-second tape movements.

As a result, in periods of weak turnover (e.g., 1H 2024), fundamental factors such as dividends and earnings showed stronger resilience.

Source: Zheshang Securities.

High-frequency strategies depend heavily on liquidity and have limited scalability. Mid- and low-frequency fundamental strategies, however, emphasize company value and long-term trends. They tolerate liquidity fluctuations better, though they lack short-term explosiveness.

The market alternates between bustling and quiet. To generate stable long-term alpha, managers must balance both: having the short-sprint explosiveness in busy times, while maintaining long-distance endurance during quieter periods.